Believe in Better

Learn about our exceptional care approach that celebrates the magical way kids see the world.

Your child’s first stop for general care, like physicals, or for routine conditions.

Care from an expert who focuses specifically on your child’s condition.

For serious injuries, illnesses, or symptoms that can’t wait for an appointment.

Convenient online appointments with Children’s physicians right at home.

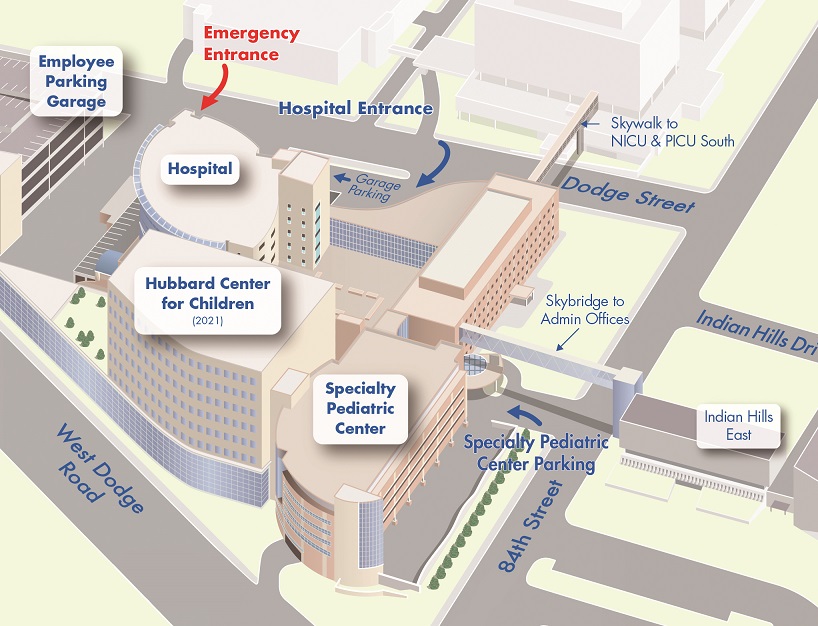

Our Locations

Find a primary care (pediatrics), urgent care, specialty care location near where you are.

pediatric specialists

outpatient

specialty services

regional

outreach clinics

research studies

underway

Jagger's Story - Home After 548 Days at Children’s

After 548 days at Children’s Nebraska, Jagger goes home for the first time! Jagger Nathan—born with a rare and serious genetic disease—spent the first 18 months of his life hospitalized at Children’s Nebraska. Torie Nathan, Jagger’s mother, had no idea there were any complications during pregnancy. It wasn’t until her water unexpectedly broke at 31 […]

Omaha mom donates more than 8,600 ounces of breastmilk in honor of late son, George

While facing the unimaginable loss of her 8-month-old son, George, Kelly turned her grief into action. With support from her family and Children’s Nebraska’s Lactation team, she donated more than 8,600 ounces to Mothers’ Milk Bank in Colorado leading up to George’s 1st birthday.

Children’s Accredited as Level 4 Epilepsy Center

Children's Nebraska has been accredited as a level 4 pediatric epilepsy center, the highest level of accreditation for epilepsy care, by the National Association of Epilepsy Centers.

Top 5 Heart Health Tips for Kids

Keep heart health top of mind for children of all ages with five tips from Children’s Nebraska cardiologist Alex Foy, M.D.

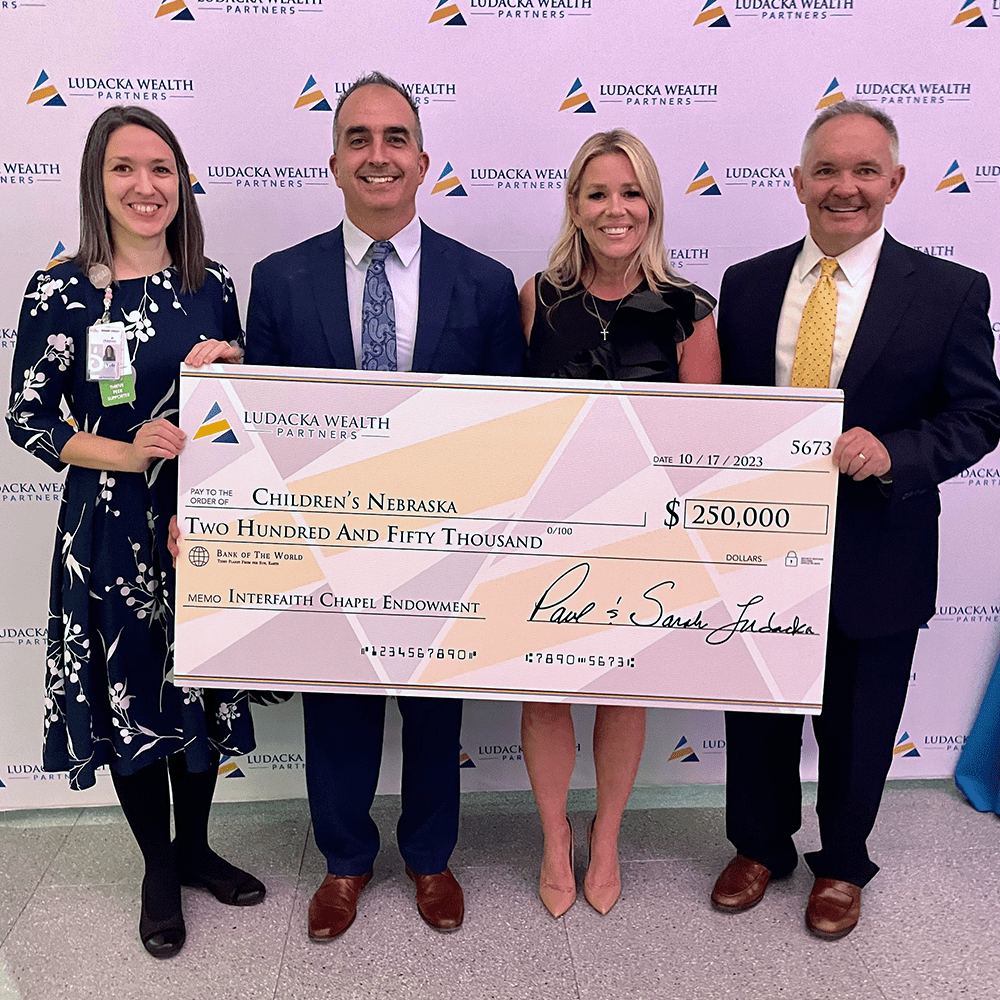

Strengthening Spiritual Care at Children's Nebraska: Ludacka Family Honored as Donors to the Pastoral and Spiritual Care Endowed Chair

Children’s Nebraska honored Omaha community members Paul and Sarah Ludacka as spiritual donors to the Endowed Chair in Pastoral and Spiritual Care on Oct. 17.

Behavioral Health & Wellness Center at Children’s

Mental Health Innovation Foundation Breaks Ground on Behavioral Health & Wellness Center at Children’s and Releases a First Look at Future Building

Center to be world-class, creating campus with continuum of mental, physical care for children and teens

Bug Bites in Children: Prevention, Treatment and When To See a Pediatrician

Bug bites and stings in children are common, but they can also be uncomfortable and dangerous. Learn about preventing and treating bug bites.

Give To Kids At Children's

When you donate to Children’s, you help ensure that children get quality care. Whether it’s time, money, or legislative support, no donation is too small.